Intelligent Monitoring and Management Platform

-

Fields of Application

Finance, finance companies, healthcare, transportation, and other industries

-

Solution Overview

The functions of the Intelligent Monitoring and Management Platform mainly include data collection, data storage, risks during the incident, risks after the incident, manual supervision, error handling, file management, data query, data statistics, system management, and other parts. The system design adopts B/S architecture, with clear business process, unified data storage, business operation, and system maintenance integrated in a unified platform, and provides a variety of system integration methods and standardized APIs for service calls to realize the integration with OCR platforms, identity verification systems, electronic printing verification system content management platforms, and ODS data warehouse.

-

Solution Highlights

1. Imaging data acquisition

Using a high-speed scanner, the system scans both sides of business certificates and converts them into electronic images. The scanned images are automatically enhanced, removing shading, black edges, and spots, and are corrected to ensure optimal image quality and the creation of complete electronic files. In addition, the system will perform a quality check on the scanned image, flagging the image as non-compliant and rescanning them.

2. Document templates and OCR identification

The system pre-sets the required checking elements based on the type of business and documents. After identifying document elements using OCR, it cross-references these with the corresponding transaction history in the core system. For documents that the system cannot automatically verify, electronic information is manually reconstructed from serial numbers, account numbers, amounts, and other elements in the images, and then checked by the system.

3. Intelligent risk monitoring

The risk point monitoring module pre-configures the business risk early warning model database based on business specifications, management requirements, authority management, time limits, operation characteristics, data characteristics, processing routines, event frequency, and operation timing within the banking transaction system. It retrieves transaction data and performs risk early warning analysis from multiple perspectives according to the model's analysis rules. When the system finds that the early warning results meet or meet the risk control conditions, it will automatically generate and record risk events, which is convenient for operators to query, analyze, process, and issue early warning information. The system can give notices on possible risks and hidden dangers in the process of business processing and realize key monitoring of institutional teller information, account management, internal settlement, accounting, and special important transactions.

4. Comprehensive business process supervision

The system encompasses real-time supervision, key supervision, random supervision, and post-event risk early warning modules. By overseeing the bank's entire business flow, including accounts and certificates, it provides early warning and tracking of potential risks within the front office comprehensive business system, business processing links, and business processes. This ensures the accuracy, completeness, and authenticity of the bank's front office business processing and outcomes. -

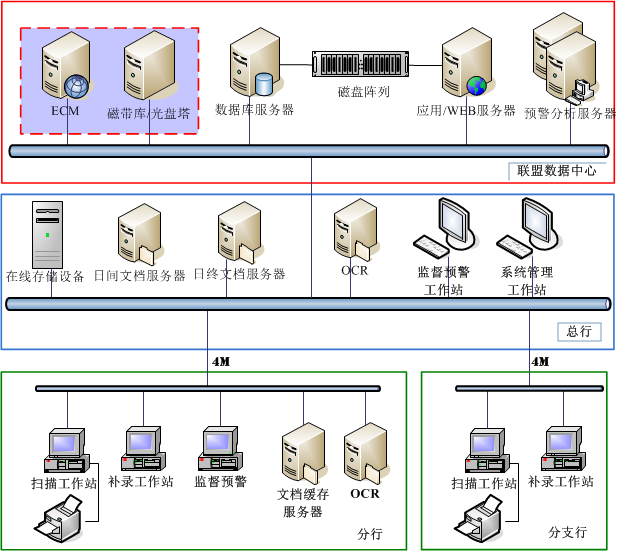

Solution Architecture

-

Business Value

- 1. Improve operational efficiency

Through the Intelligent Monitoring and Management Platform, banks can monitor business risks, employee operational risks, system implementation, and other information, which helps to achieve optimal allocation of resources, reduce waste, and improve operational efficiency.

- 2. Risk prevention

Through data collection and analysis, the intelligent monitoring platform can timely detect and warn of potential problems and risks, and avoid losses. At the same time, for scenarios such as safety specifications, the intelligent monitoring platform can also provide more accurate and efficient identification and early warning.

- 3. Provide decision support

The intelligent monitoring platform can provide comprehensive and accurate decision-making support for banks’ operation and management after processing and analyzing the collected data, which will help banks better understand business trends and formulate a more scientific and reasonable development direction.

-

Application Scenarios

Scenario 1: Paperless counters

Business personnel can directly view PDF files uploaded by the paperless system within the monitoring system, supporting simultaneous display of both PDF files and business images on the same page.

Scenario 2: Video supervision

The system offers video matching for business scenarios or security purposes, enabling supervision of both business and non-business matters. During video supervision, it allows simultaneous viewing of core processes and accounting entry information.

-

Successful Cases

No.

Customer Name

Project Name

1

Zhangjiagang Rural Commercial Bank

Integrated Ex-post Facto Monitoring System

2

Taicang Rural Commercial Bank

Integrated Ex-post Facto Monitoring System

3

Bank of Suzhou

New Ex-post Facto Supervision System

4

Chang'an Bank

Integrated Ex-post Facto Monitoring System